Why does the AG's office redact outside litigators names? Medicaid Spending in CO and the Provider Tax. $25 million to 16 grantees for affordable housing.

Why does the AG's office redact outside litigators names?

As part of a look at AG Phil Weiser's lawsuit binge against Trump (see the first link below for that newsletter if you want/need the context), I came across something curious when a ran a TOPS** expense report for 2025 for the Colorado Department of Law.

That spreadsheet is linked second below. Feel free to look around in there. Find something interesting, give me a heads up. I highlight it in screenshot 1 attached.

"Vendor Name Redacted"

Now, call me suspicious if you want, but I see redactions and it gets my attention. Why hide the names of the people you're giving tax money to? And, to be clear, I'm not alleging any conspiracy or nefarious activity.

Still, redacted for some reason.

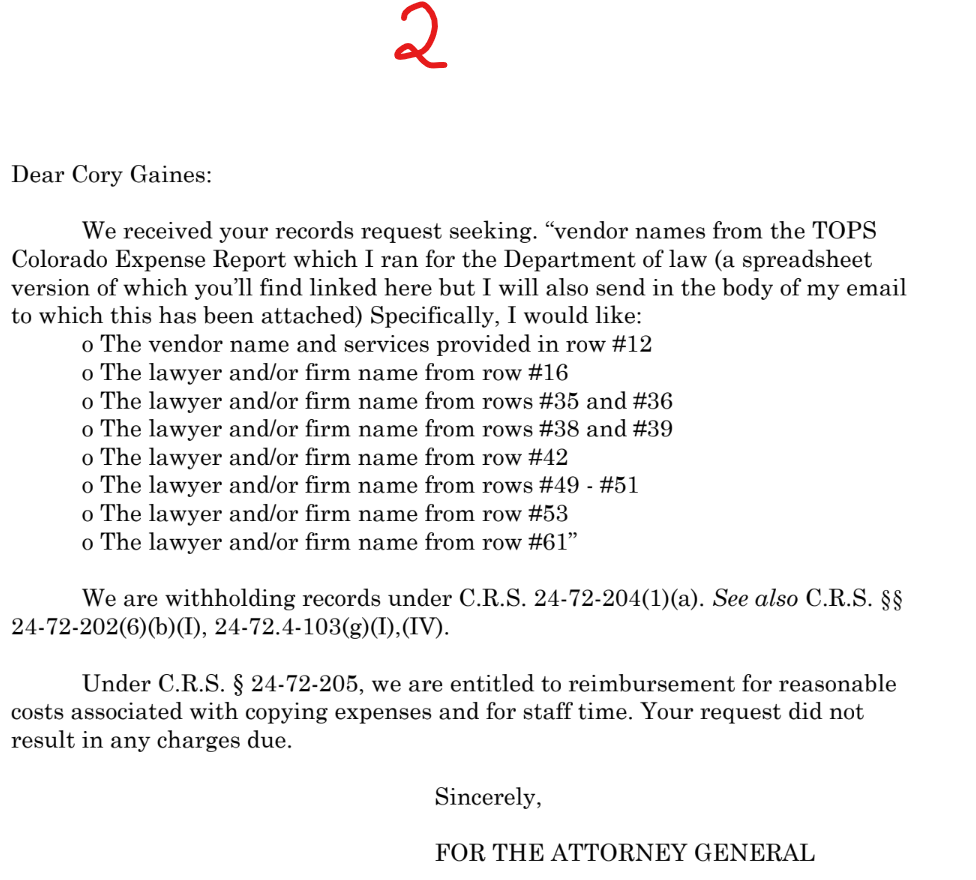

In an effort to learn where our money was going, to whom, I started with a CORA request to Weiser's office to get the names of a few (not all) of the redacted line items in the ledger. The response from the AG's CORA records custodian is shown in screenshot 2.

I had to have some help in understanding the legal citations his office tossed at me before closing the door on my face. I still don't fully understand them all, but the short version as I understand it is that they're denying access to the records I asked for due to a trade secrets exemption, and because they're calling some of the records criminal justice records (which go under different rules than CORA requests).

I reached out for some advice to friends who know a little bit more about CORA denials and state statute than I do (sounds perhaps more impressive than it is--a lamppost knows more than I do), and have emailed back to the AG.

I'm not ready to give all the details because I'm still waiting to hear on some other lines I have in the water on this issue, but I can tell you this.

I'm not going away quietly and the issue is far from dropped. To the extent that it is legal to do so, you and I have a right to know where our AG is sending our money.

More to come.

**TOPS expense reports are basically a searchable checkbook register for expenses our state has paid. Great resource, one I've used often. If you're curious to know more send me a message and I'll point you to it.

https://open.substack.com/pub/coloradoaccountabilityproject/p/there-but-for-the-grace-of-god-goes?r=15ij6n&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

https://docs.google.com/spreadsheets/d/1DsAhIlvb2Y9oE-22Z1GMIum_A-Pio2Rb/edit?gid=482469820#gid=482469820

Medicaid Spending in CO and the Provider Tax: a tax (per the Sun) that hospitals love to pay?

I have to admit, the Sun's headline (see the pic heading this post and the article itself linked first below) got me. Who in their right mind wants or likes a tax?

Here's the key. Due to a quirk in Federal rules, by paying taxes some hospitals, sometimes, get more money back than they pay in. Yeah, I'd probably like a tax where I paid $5 and got $10 back. In short, the taxes we all seem to like are those where other people's money comes to us.

Quoting from the story:

"The taxes [the so-called provider taxes which tiny rural Colorado hospital] Lincoln pays help cover the state’s Medicaid costs and — because the federal government matches a portion of what states spend on Medicaid — enable Colorado to claim more federal money. That generally leads to more dollars for the hospital. The tax proceeds also have helped Colorado expand Medicaid under the Affordable Care Act to cover 400,000 more low-income adults, significantly reducing the number of people showing up at hospital doors without insurance. Last year, Lincoln paid $500,000 in provider taxes but netted more than $3.6 million extra from Medicaid, accounting for about 15% of its budget, said Lincoln CEO Kevin Stansbury."

Damn $3.6 million back for $500k (a multiplication by 7x) makes my example look quaint!

Anyone with a functioning brain knows that money doesn't just fall from the sky. So how's this work?

The second link below is from congress.gov and gives a thorough rundown on both Medicaid financing and provider taxes. Poke around all you want in there, but the upshot is this. States run Medicaid, a program they voluntarily sign into. States fund and administer the program within some guiderails set by Federal law.

The state is required to fund the program, but the Feds will match a certain percentage of the expenses based off of per capita income. This funding, of course, comes with strings. There are rules about how it can be spent. Further, states' shares of Medicaid funding can range from 40% to 60% off the entire cost. States commonly fund their share via state taxes and local taxes.

Let me repeat that last part for emphasis so you have it in your pocket as you read about the horrors Congressional Republicans are visiting upon us regarding Medicaid: Medicaid is administered by states. The Feds kick in varying amounts of money. Outside of some guardrails, the program is run and (mostly) funded by states.

So how do provider taxes figure in the mix?

Screenshot 1 comes from that same congress.gov page and gives a breakdown schematically.

If you're like me, however, the diagram ain't going to be enough on its own. Let's walk through it. The key lies in my statement above that the states fund Medicaid which the Feds match.

The states can fund their part in multiple ways, and provider taxes is one. The state takes money from hospitals, nursing homes, etc. In the diagram, in our hypothetical case, the state has assessed taxes on all nursing homes and has received $10 million in revenue.

The state then pays all the nursing homes with Medicaid enrollees $8 million for those Medicaid patients. This is different than the provider tax, which assessed ALL nursing homes regardless of Medicaid enrollment. The Feds then match this $8 million at 60% for our hypothetical state, giving the state $4.8 million ($8 million X 60%) in Federal money.

Let's run through the totals here. The state took in $10 million in taxes. It paid out $8 million to some nursing homes. It received $4.8 million from the Feds. 10 - 8 + 4.8 means the total state revenue was +$14.8 million.

Less the $8 million in cost (what the state paid out), means the state netted $6.8 million, and here's the important bit that's easy to miss, this $6.8 is now state money and thus doesn't need to be spent according to Medicaid rules!

It is this last bit that causes some people to be upset about provider taxes. On the one hand, a provider tax is as good a way as any to fund care, and it fits with the already-natural pattern of social service funding. The many pay for the few that (presumably) can't. So take via income or property taxes, take from providers (thus customers), however it happens the state has to take from someone.

Besides the obvious--that the states can use provider taxes to be fiscally irresponsible and saddle the national taxpayer with state-level decisions--the issue many have with provider taxes is the lack of accountability to the Feds for their matching funds which ought to come with Federal rules attached; the problem many have is that provider taxes can be abused such that the money gets "washed"*

A couple of non-contiguous quotes from the Sun article flesh this out:

"Brian Blase, a former Trump health policy adviser who leads the conservative Paragon Health Institute, sees provider taxes as one of the highest forms of waste in Medicaid. States and their hospitals, nursing homes, and other providers aren’t held accountable for how the tax money is used, reducing incentives for states to control Medicaid spending, he said."

"In recent years, California has extended full Medicaid coverage to immigrants lacking permanent legal status. Federal law prohibits federal Medicaid dollars from being used to cover people in the country without authorization, but states can use their own money. At a presentation to congressional staffers in April, Blase cited California’s strategy as an example of provider tax abuse and claimed the state is effectively laundering federal funds to cover people living in the U.S. without authorization."**

Our state has, per the article, bought in heavily on provider taxes. Our state also took advantage of the ability to expand (spend more and offer more coverage) Medicaid when Obamacare passed. Let's all wave hello and thank then-governor Hickenlooper.

If the Feds decide to lower Medicaid reimbursement or put more guardrails on them, expect Colorado to howl in part because of the expansion and because of the use of provider taxes.

We'll probably lose some matching dollars and our expenses for compliance with Federal rules will go up, but it is also important to remember that our state (since Hickenlooper) CHOSE to spend more too. We put ourselves in a position of offering things to people that we weren't funding ourselves.

*One of the opponents of it is cited in the Sun article as saying it's money laundering, this caused some of the hospitals that receive the extra money to object.

**I will be looking into provider taxes and Medicaid more in future post(s). I will try to see if any of our provider tax funding is used for illegal immigrants.

Related:

Suggested to me by a friend when I reached out for more resources on Medicaid in Colorado, but arriving after I wrote the post above.

The link below is to a Mandy Connell show from 5/19. She talks with Brian Blase about changes to Medicaid under Obamacare (if you're thinking it got bigger and enrolled more able-bodied, childless adults, you're right--in addition to putting more costs for that expansion on the Feds), and then further expansion under Biden.

Starts at about the 38:15 mark.

https://koacolorado.iheart.com/featured/mandy-connell/content/2025-05-19-88-the-mandy-connell-podcast-05-19-25-full-show-the-medicaid-grift-and-bide/

$25 million to 16 grantees for affordable housing

In 2022, by a vote of about 52% for (see also the screenshot of the county election results from the secretary of state's page) voters approved Prop 123.

Prop 123 forces the state to dedicate 0.1% of its tax revenues to affordable housing. This isn't a tax increase, it's an earmark: if memory serves the current income tax rate is about 4.55%. The state must set aside 0.1% of that revenue aside for certain affordable housing measures. The balance, the 4.44%, goes wherever tax revenue goes.

Quoting from the Dept of Local Affairs website on Prop 123 (seen in the picture at the header of this post--taken from the first link below):

"Voters approved Proposition 123 in 2022 which created the State Affordable Housing Fund. The Fund allocates 40% of its funds to the Department of Local Affairs (DOLA) and 60% of its funds are overseen by the Office of Economic Development and International Trade (OEDIT) and managed by the Colorado Housing and Finance Authority (CHFA) on OEDIT’s behalf. DOLA, OEDIT, and CHFA oversee this funding, which is provided through grants and loans to nonprofit agencies, community land trusts, nonprofit and for-profit developers, and local governments. Each program has its own applicant, program guidelines, and selection criteria."

The first of the grants are in, according to the CPR article linked second below. Quoting that article (leaving its link intact):

"On Wednesday, nearly $48 million in Proposition 123 Land Banking money was granted to groups to help with the housing. Governor Jared Polis, the Colorado Office of Economic development and international Trade (OEDIT), and the Colorado Housing and Finance Authority announced that the funding would be distributed among 21 recipients in various Colorado communities."

Screenshot 1 gives the list of grantees awarded along with amounts. It was funny to me to read about how the money went according to the article, to "various Colorado communities". Those various communities are mostly up and down the I-25 corridor with the exception of 3 out of 21 grants, or 6.1% of the money.

The temptation here is to complain about the whole state (again) paying so that the big cities along the I-25 corridor can have things, but that would be overly simplistic. Grants are voluntary things, and, without knowing who applied and who didn't, there's no way to establish whether there was any favoritism at play. This much I can say with confidence, if nothing else this is an object lesson to smaller communities: speak up and toss your hat in the ring on things like these if you haven't already. You're paying for them!

One last thing by way of a joke, something that made this math/physics teacher laugh. If you follow the links back to earlier CPR reporting through the article, you will see that in Oct 2022, Mike Johnston one of the backers of Prop 123 (and NOT the mayor of Denver, he is CEO and president of Gary Community Ventures) estimated this would create 10,000 affordable housing units per year.

When I add up all the housing units in the CPR article, I arrive at 1886. For $48 million, that averages $25k per unit. If we were to hit 10,000 a year, that would be (using my average above) $250 million a year, well within the $300 million allowed. So far so good.

1886 is well short of the 10,000 predicted, however. Perhaps this is why, post-election, in a different CPR article, Johnston had dropped his figure to 170,000 units over two decades.

Makes one wonder if Johnston will keep revising down.

https://cdola.colorado.gov/prop123

https://www.cpr.org/2025/05/09/prop-123-48-million-affordable-housing/