Truth in Taxation and Revenue Limits for Prop HH? One is bait and switch. The other is a great idea, but not at the cost of passing the turd that is Prop HH.

What are truth in taxation and revenue limits in Prop HH? Let’s start with a focus on revenue limits—I may surprise you by saying this, but they’re not as limiting as you’d think.

Two of the selling points Democrats will use for Prop HH, the so-called "truth in taxation" and "revenue limits" are, as you might imagine, not quite what they're cracked up to be.

I posted a bit back about how the Assembly Democrats ignored any suggested changes made by the public, and voted down any amendments offered by the Republicans, to the Blue Book language on Prop HH.

There is a seemingly small, but quite important change that was suggested we should all be aware of because without this change it may appear as though Prop HH is doing more good than it will actually do.

As before, I turned to Ms. Menten and the good work that she is doing in conjunction with Free State Colorado. Their video which goes into great detail on this topic is linked below.

I will abstract it here for you.

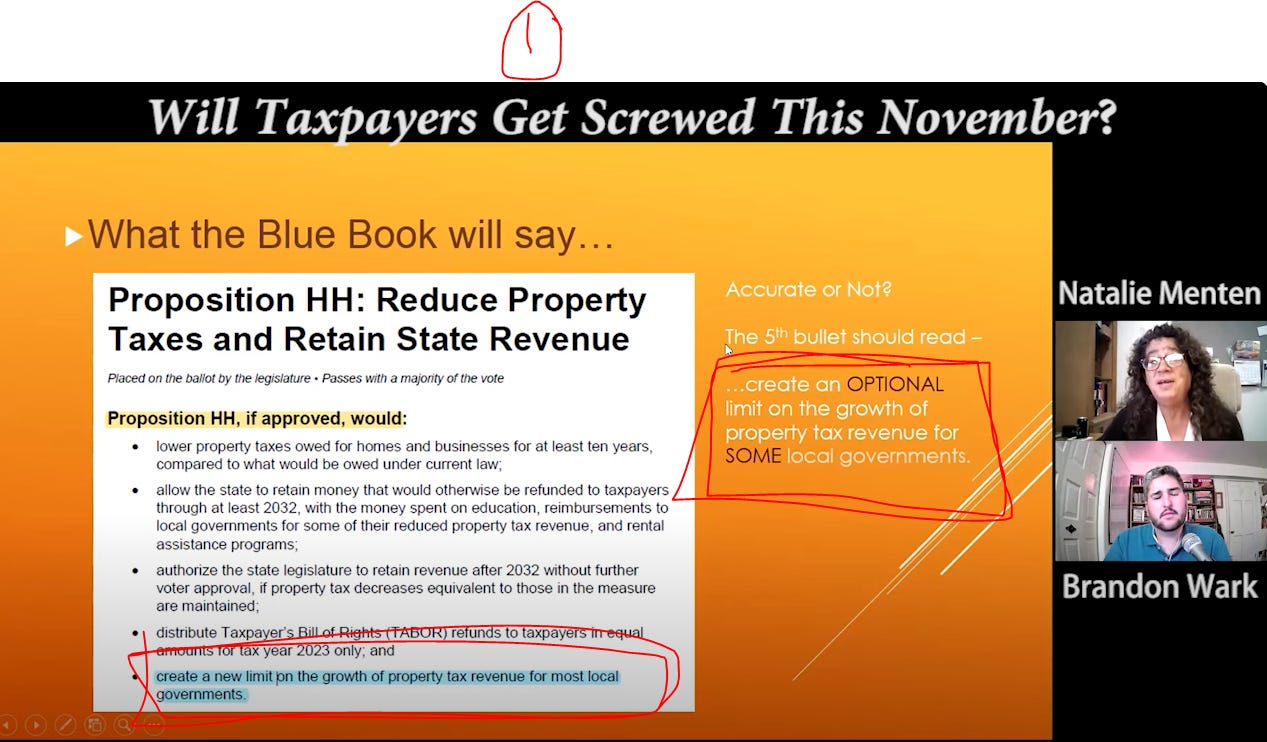

Take a look at screenshot 1 attached. It shows some of the language from the Blue Book that describes what Prop HH would do if passed.

The bit circled in red in the lower left shows the language approved for the Blue Book. The bit circled in red in the upper right shows language that advocates like Ms. Menten fought for at the hearing (and were ignored for their trouble).

The change in tone and meaning is pretty obvious here if you look at the language that, frankly, should by rights have been included.

Let's talk about what's going on.

First some background.

There were, in addition to the protections homeowners had under the Gallagher Amendment, there were two mechanisms that kept property taxes from spiking: TABOR and the 5.5% revenue cap. TABOR doesn't just restrict the state government's revenue, it does for local governments too. Additionally, there was a law that limited any property tax revenue increases to 5.5%. See screenshot 2 attached (from the video if you want more context).

Unfortunately, many local districts long ago voted to de-TABOR local revenues and to remove the 5.5% cap. Logan County (where I live) did this way back in 1997, see screenshot 3. I did a post earlier on this topic if you can find it in the stacks and want to see the process so you can check your own districts.

If memory serves there are still some counties with TABOR and/or 5.5% protection but the list is short. So chances are you're like me and sitting without any strict legal means to enforce your local governments giving money back above the limits set by TABOR and/or the 5.5% revenue cap.

Never fear, however, because the Democrats are coming to your rescue with Prop HH!

You see the Democrats in this state and the backers of Prop HH will try to push the selling point that Prop HH will reintroduce both "truth in taxation" (see the next post) and put a limit BACK on property tax revenues going forward.

If you know anything about politicians or about the way that the Democrats have handled Prop HH up til now, you should be wary. That's because there are some important details missing.

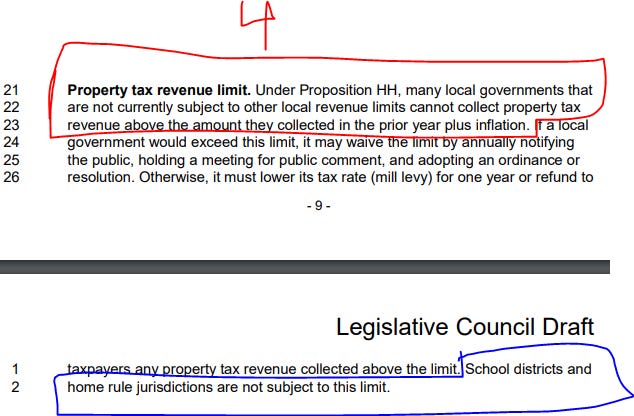

Turning to the final draft Blue Book language on Prop HH, which is linked second below, I want you to take a look at screenshot 4. Look first at the bit marked in red. Sounds good no?

I mean, if Prop HH passes, local governments, almost all of which in this state long ago held elections and removed any TABOR or revenue limits will now have to have a revenue limit. They won't be able to collect any more money in the coming year than they did in the previous year plus inflation.

Except ...

Except that, if you look down at the part boxed in blue you'll note that schools and home rule jurisdictions are exempted from this.

Guess which group eats up the biggest share of your property taxes? To quote Ms. Menten in the video "the school district is one of the biggest line items on the property tax bill".

They are exempt from any limits whatsoever! Said another way, while the Democrats will tell you all about revenue limits and truth in taxation, what they won't tell you is that schools have no limits and can rake in all the extra revenue they'd like when property values go high.

This, along with the fact that the state will essentially be passing your TABOR refunds along to schools, should make it pretty plain to see why it is Prop HH has the enthusiastic support of teacher's unions.

Prop HH will be quite a payday for them!

Next post up will be on the "truth in taxation" claim.

And now for truth in taxation: a great idea but at too big a cost if we get it through Prop HH. Would be better to see the Assembly take this up next session and do it on its own.

Truth in Taxation--a good idea, but let's dig in on what Prop HH will actually do, and what it won't.

The post previous to this one talks about one of the selling points that the Democrats will use for Prop HH: a revenue cap to keep your bill low. If you didn't read, I suggest checking it out.

The other selling point (and this is one I've heard Polis tout when he's been on the trail schilling for Prop HH) is what they call Truth in Taxation.

Truth in taxation is a good idea in my view. I think it is something we should push for, but I want you to be aware of what you're getting with Prop HH's version ... and what you'll not be getting.

Let's start with the basics.

The idea behind truth in taxation is that taxing authorities should be informing the public of what's going on. We already have some protection for this with TABOR: taxing authorities have to ask us to raise taxes**.

There is no (especially after many localities voted to waive their protections) protection against a taxing authority taking more revenue than they need when property values make revenues go way up, however, and that is what truth in taxation is supposed to be there for.

The basic idea is that the taxing authorities should inform you when the tax revenues will exceed a certain amount. Truth in taxation a la Prop HH (see screenshot 1 attached from the same Blue Book final draft language as in the previous post) has it that taxing authorities that will exceed the last year's revenue plus inflation need to follow a procedure of informing the public and seeking comment and waive the Prop HH revenue cap.

The details on this procedure are in the video linked below where Free State Colorado and Ms. Menten go through them in detail, but the upshot is that the taxing entities must give you notice and hold a public hearing if they intend to keep the excess revenues. See screenshot 2 attached.

This sounds like a good idea: I like it that any local entity which would take in excess revenue has to declare that they intend to keep it (or not) in a very public way.

I just wish it were not attached to the turd that Prop HH is. I hope that if Prop HH fails, our Assembly steps up to revisit the idea of truth in taxation.

One last reminder before signing off. Any home rule jurisdictions (Denver, I'm looking in your direction) and school districts would not have to do this truth in taxation process. They're exempted.

Something to remember and share.

**Unless they're like the state level politicians then they call it a "fee" and move on--something Democrats have raised to high art in this state over the last few years.

https://leg.colorado.gov/sites/default/files/initiative%2520referendum_prop%20hh%20final%20lc%20packet.pdf