Part 1 of 2: Checking Polis' claims on Prop HH. Economic impact of CPW's limiting hunting licenses. Why are guns considered exceptional?

Checking Polis' claim on Prop HH and taxes in general. Part 1 of 2. Part 2 comes tomorrow.

Since CPR's Ryan Warner (nor did KOA"s Ross Kaminsky frankly) let it pass by without comment, I'm going to wade in here and do a quick sanity check on Polis' claims re. Prop HH.**

More details are below, but let me quickly summarize the top points of this post for you here:

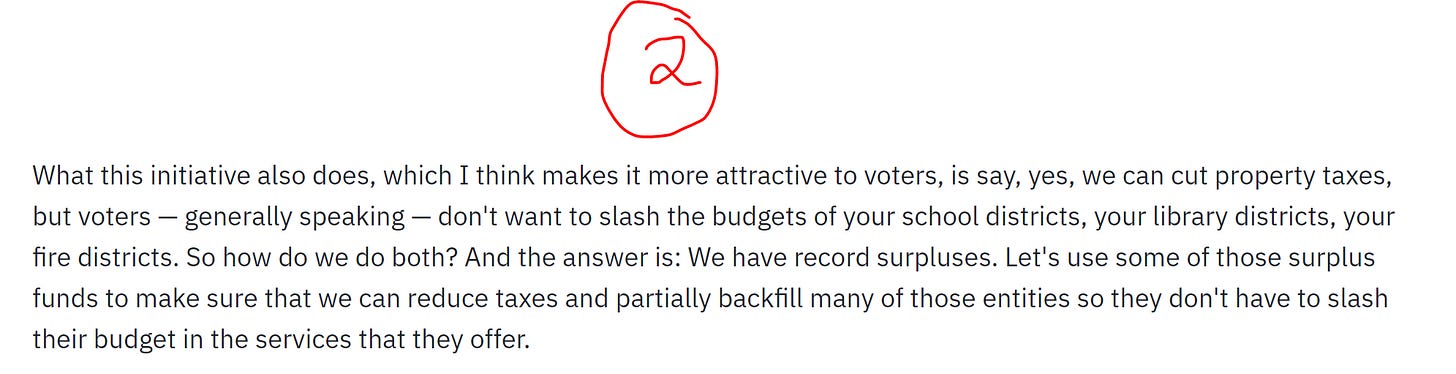

1. Watch the rhetoric. Regardless of whether Prop HH passes, you will still pay more in taxes. Estimates vary, but the December 2022 Legislative Council Staff forecast says that, without Prop HH, your homes assessed value will go up by 22.5% and with Prop HH it will go up 19.8% next year.

2. Your local government will not (repeat WILL NOT) be losing money whether or not Prop HH passes. It will just not get as big an increase if Prop HH passes.

3. In order to make Prop HH more palatable to local governments, the state is using your TABOR refund money to make sure that the local governments will get as big an increase in money as they would have had Prop HH not passed. That keeps them quiet

Okay. Let's get started.

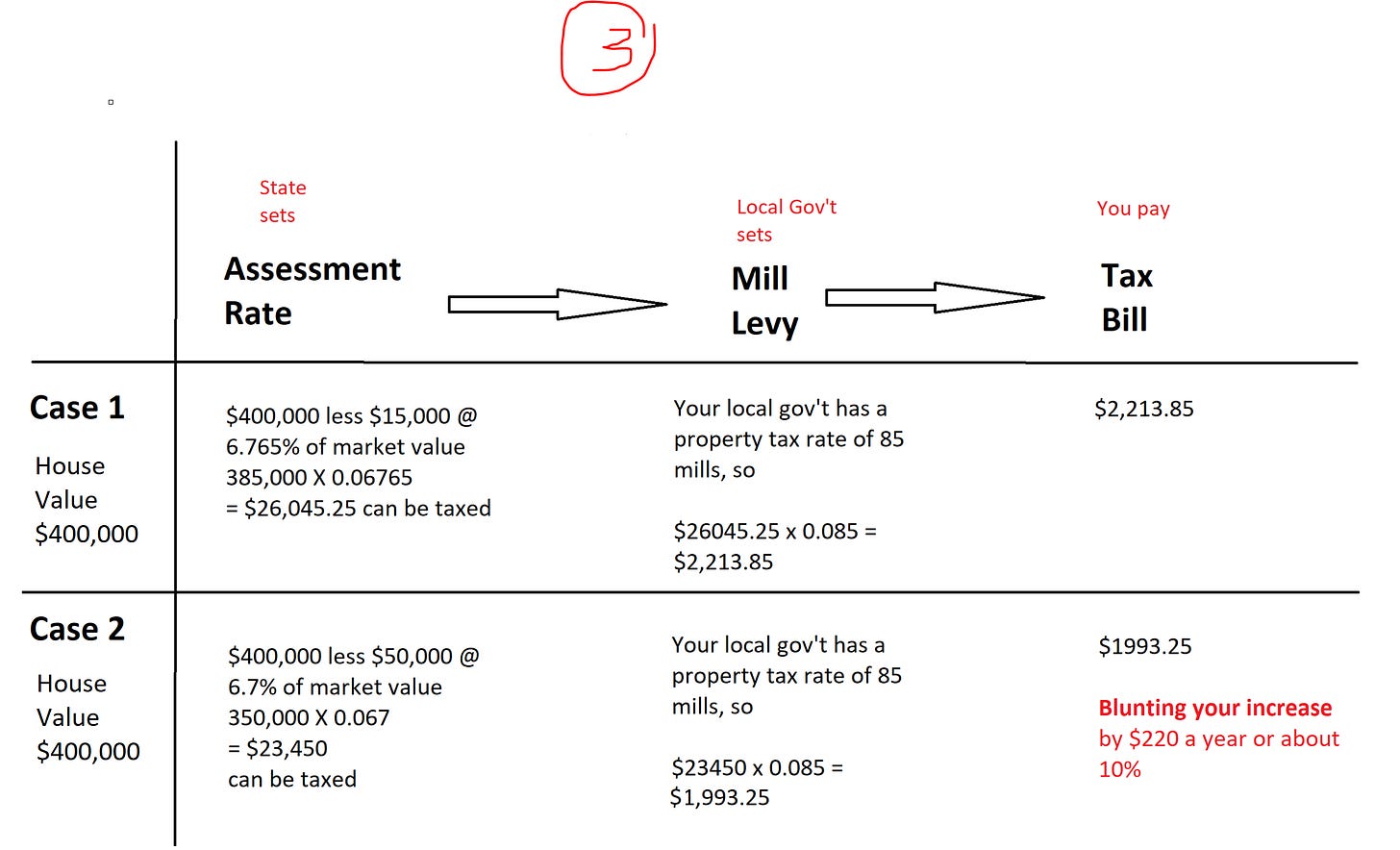

Before we get into Polis claims, let's step back quickly and review how the roles of the state and local governments differ in the process of calculating your taxes.

--The state decides on how much of your home's market value can be taxed, and they decide what percent of that value is taxable.

--The local governments decide on how much to actually charge you.

Take a look at the quick diagram I attached as screenshot 3. The values I used here are based on the alternatives listed in the Fiscal Note for SB23-303 linked second below.

Under the way things currently sit, the state takes $15,000 off your home's value and then says that 6.765% of that value is eligible to be taxed. Starting with a house value of $400,000, you see what your taxable value is in row one of the table.

If Prop HH passes, the state would instead take $50,000 off your home's value and then tax you at 6.7%. The same $400,000 home under these conditions is listed in row two of the table.

If Prop HH passes, an everyday homeowner will find their TAX INCREASE BLUNTED by 10%.

I cannot stress this point enough. We are not (repeat ARE NOT) talking about an overall decrease here, we are talking about lessening the increase. I.e. instead of your bill going up by roughly $2200, it will go up by roughly $2000.

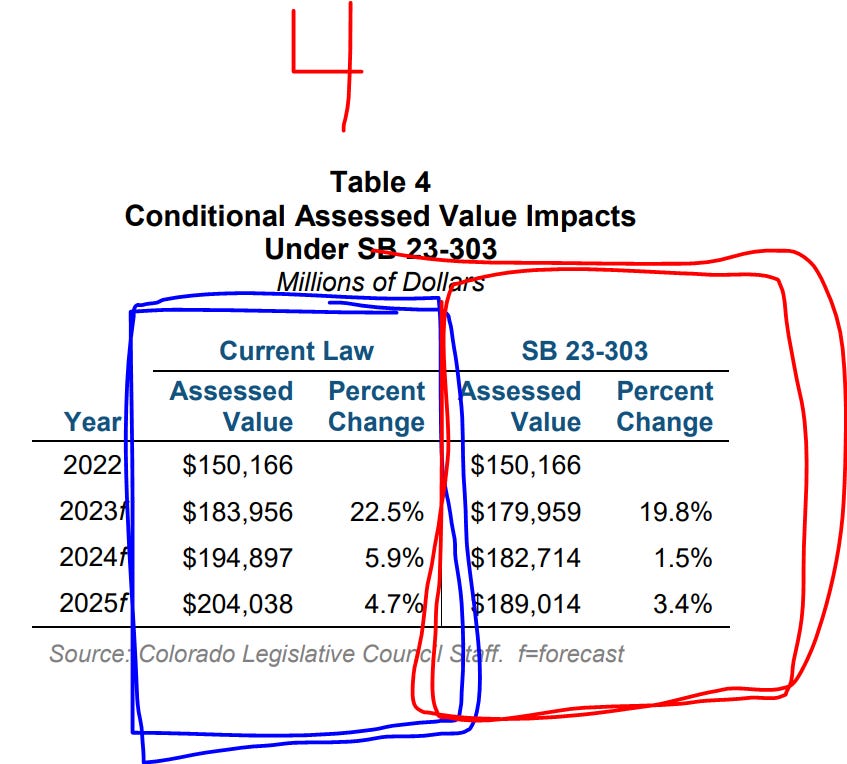

Let me go further. Take a look at screenshot 4 attached. This is a direct copy from the fiscal note linked second below and uses forecasts by the non partisan legislative staff.

The part boxed in blue is the predicted increase in your assessed value of your home if Prop HH does not pass. The part boxed in red is the predicted increase in your home's assessed value if Prop HH does pass.

What do you see? Both go up. Both are an increase. It's just that if Prop HH passes, the increase is blunted by about 2.7% in the first year, 4.4% year two, and 1.3% in year 3.

What happens at the local level?

The exact same thing. At the local level, since the money they bring in is proportional to the assessed values of the homes in their region, the percentage changes will roughly mirror the percentage changes in the assessment rate.

That is, whether or not HH passes, your local government will still get more money in the coming year than it did previously. The decision is whether it increases by 22.5% or whether it increases by 19.8%.

Now, as you might imagine, no self respecting local government would take less of your money quietly if they could have more so the state is buying their silence on Prop HH by making sure they get money they might otherwise not if the state reduces the assessed value.

That is (and for more detail, I refer you to "Local Government Backfill" on p 5 of the fiscal note) the state will pay local governments for any lost tax revenue below what they'd get based on the current law of the land, SB22-238 last year's Band-Aid on the problem, should Prop HH pass.

In brief here is the scheme for Prop HH.

--Polis proposes lowering your property tax bill by the state cutting what it can, the taxable value of your home.

--That means your local government will only get $120 this year vs. $100 last year (as opposed to your local government getting $122 this year to last year's $100 if HH doesn't pass).

--Polis then turns around and makes up the "missing" $2 to your local government by taking your TABOR refund money.

In part 2, let's look at what Polis said in his interview in light of these facts.

**A note on sourcing Polis' quotes. Both of the attached quotes (screenshots 1 and 2) come from Ryan Warner's interview with Polis which I linked below.

https://www.cpr.org/2023/06/14/jared-polis-property-tax-ballot-measure-interview/

https://leg.colorado.gov/sites/default/files/documents/2023A/bills/fn/2023a_sb303_r5.pdf

I hadn't even considered the economic impact ...

Colorado Parks and Wildlife, citing concerns over hits to the population of game animals** is severely limiting the number of hunting licenses (and shortening seasons) to prevent overkill.

The part that I don't think I accounted for (since I'm not a hunter and not involved economically in hunting in any way) is the impact this will have on the economies of areas that depending on hunting.

Looks like the answer is that it's not going to be good.

If you read the article below, you'll get a sense of just how much the areas that depend on hunting .... depend on hunting. I'll leave it to you to read the article, but there are a couple noteworthy takeaways here worth special mention.

1. I mentioned recently finding a passion and speaking up at public meetings. CPW holds meetings. If you know of someone for whom hunting is a passion (or a business) or if you are that someone, go to CPW's site and sign up for updates. Get in line and speak up.

2. As much as I bag on the Sun for their coverage, I have to admit to respecting them for covering things like this so that people like myself can learn about problems they wouldn't otherwise (and share them with you too).

**I would like to remind you of something else that limits game animal populations: wolves. Wolf reintroduction will have an effect on animal population and thus also on hunting licenses with its attendant economic implications.

https://coloradosun.com/2023/06/11/cpw-hunting-license-cuts-economic-impact/

Gun exceptionalism.

I put up a screenshot of the word exceptionalism, because when I talk about gun exceptionalism, I want you to remember that I mean exceptional in the sense of "an exception, a thing to be treated differently" as opposed to "phenomenal or better than".

Why are guns exceptional? I ask this question genuinely to spark some thought and/or conversation.

Let me flesh out what I mean.

If you listen to as many gun control advocates as I do, one of the major arguments made with regard to limiting gun ownership (by age, by a waiting period, etc.) is the fact that young people still haven't fully developed their frontal lobes, the so-called "executive function", that helps in decision making and seeing future consequences of current actions.

Fair enough. A reasonable argument to make. If young people (young often meaning as it does to gun control advocates up to age 21) are more impulsive, we be careful in what we allow them and when.

But, making this argument runs into a double standard for me:

We allow people access to a vote, a thing which could affect policy for all of us, at an age that is younger than some would want them to have access to a gun.

We allow people access to cars at a far younger age than we do for guns even now.

We allow them access to abortions at younger ages than we allow them to drink or own a handgun.

It's even been proposed to allow them access to body changing hormones and drugs from the same age at which some want to stop them from owning or buying guns.

Why the exceptionalism about guns?

I'm not proposing a free for all. I'm not a Second Amendment absolutist.

I'm also not saying that any of the above are perfect analogies.

Still, if you sit and think about what could be done with a car in the hands of someone sick enough and motivated enough, you'll have to agree that it's not all that different than what could be done with any of the guns that are legal right now.

Still, if you are of the mind that abortion is the taking of another human life, we are putting the decision to end a life in the hands of someone we don't trust to own a weapon that could be used to end a human life.

Still, the things on my list either have the potential to (or do) cause radical change to the user's life.

I would love, and I say this from genuine curiosity and not as a challenge, to hear someone's thoughts on this that disagrees with me. What do you see as the hole or as the gap in my thinking? There must be some part at least. I am well past the age at which I think I know everything after all.

Further, if you do admit double standard, what do you see as the way out? Abortions for all, guns for all? Neither are allowed?

Please share your civil thought/comment below.