How should we do property tax? Not just how much, but how? JeffCo knowingly overtaxed and kept your money locked down.

How should we do property tax? Not just how much, but how?

I saw the discussion between Jon Caldara and Joshua Sharf (both of the Independence Institute with the video linked first below) and was intrigued.

With as much as property tax has been in the news, with as much cross talk as there has been about the various schemes to offer relief, I found their discussion interesting. In particular, it was interesting to note how other states have handled property taxes and the (sometimes) wild swings in taxes due to property valuations changing.

During that discussion, there is mention of the Independence Institute's model property tax policy for Colorado (read: their recommendation to fix the current property tax problems). I found that report and linked it below the video in case you want to see it in full.

Note that the report contains the history of property tax in Colorado, what other states have done, a look at the fitful attempts by our state government to try and fix the problem post-Gallagher, and the model policy.

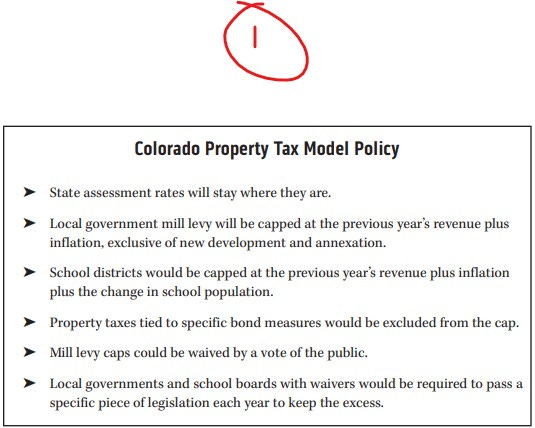

If you are short on time and wanted a quick overview of that model policy, I attached the report's summary as screenshot 1.

If you want to see a discussion of the recommendations in the video, start at about the 24 minute mark.

Take a second (even if it's just a brief look, it's still worth it) and look at what other states have done or are doing, and take a second to look at the model policy.

Whether you like the individual items or not, having seen a variety of ways of approaching the problem helps you better understand the things that Colorado's government is proposing, helps you compare and contrast.

https://i2i.org/review-of-colorados-property-taxes-and-model-policy/

JeffCo knowingly overtaxed and kept your money locked down.

And then they turn around and ask whether or not you will let them keep extra tax money from now til forever.

Natalie Menten shared the link below with me. She is also featured in the story. In the interest of full disclosure, she is also running for a JeffCo commissioner seat and has my endorsement for that seat.

The story details how JeffCo knowingly overtaxed its residents, held on to that extra money, and is now asking (via JeffCo Measure 1A) to keep not only that extra revenue but future TABOR surpluses as well.

It worked like this:

--JeffCo was collecting too much tax revenue. So much, in fact, that the state was telling them they needed to lower their mill levy rates.

--JeffCo told the state that, unlike other counties that have de-TABORed, JeffCo would just issue refunds in August or Sept.

--Then, conveniently, the JeffCo commissioners decided to issue refunds AFTER the election. Or not. If they could convince voters to vote in their tax increase ...

In the story, JeffCo issued a statement explaining their convenient decision (quoting the story):

"Jefferson County released a statement saying: 'The county is within the timeline established by state statute to issue property tax refunds. Waiting until after the election ensured that the county in no way influenced the results of the election.'"

Bless them for thinking about fairness.

Oops, I think the JeffCo commissioners forgot one thing. As noted in the article, this was the same county that recently spent $300K on a politically-connected, Democrat consultant to help them with their effort to pass the de-TABORing measure.

Help me out here JeffCo commissioners, was that influencing the election?

https://www.cbsnews.com/colorado/news/ballot-measure-1a-allow-jefferson-county-keep-30-million-dollars-tax-revenue-knowingly-overcollected-colorado/

Related:

A couple endorsements

I mentioned in the post above that I support Natalie Menten for JeffCo commissioner. If you are voting in JeffCo, or know someone who is, look over the links below (or send them). They are to her website and a candidate profile.

While on the topic of endorsements, let me skip over to an RTD race and remind you about my endorsement for Kathleen Chandler (her site and a candidate profile linked below too).

Both of these women are the kind of thoughtful and fiscally-responsible people we desperately need in government in this state. Please look over/share the below and give serious thought to a vote for them.

We get the leaders we deserve and elect and it's time we thought better of ourselves and who is running things.

https://nataliementen.com/

https://www.chandlerforrtd.com/

https://www.cpr.org/2024/10/14/vg-2024-rtd-district-f-candidates/

How about removing public schools from the residential property tax altogether? Public schools are governed by the state, anyway. For example, teacher certification, curriculum, teacher retirement funding and payouts, etc, Why not make teachers state employees and pay them salaries and benefits as the state pays its employees through its human resource department? This would stop teacher job shopping and the endless whining about one school district paying more than another' You need to fund public schools in a manner not based on how many rooms a house has or what neighborhood the house is in. Apartment renters have no business voting to raise the taxes of their landlord.