HB24-1014 adds to biz's legal burden. A couple of bills on farming and ranching you should support. Go easy on 'em Polis, House Dems just took the heat off you.

HB24-1014 dramatically adds to the legal burden on business in this state.

I wrote a post a bit back about the LEGAL burden our state is placing on business (see the first link below if you want a refresher).

I wanted to follow up on that with a bill that, as of my last check, passed the House and is now on its way to the Senate. I thought it would make a good object lesson of what I'm talking about because this bill makes it much easier to sue a business here in Colorado. This bill is linked second below.

First some prerequisite material.

Remember that our legal system works in the common law tradition. That is, our laws are written by legislators, but some specifics, some details of how those laws are interpreted are built up over time by judges.

As a hypothetical, consider the following. Let's say that a law said it was illegal to impose "retaliatory" rent increases on someone, but didn't specifically delineate what that term meant. The first time someone brought a suit against a landlord for such an increase and won, that judge's decision as to what "retaliatory" meant in detail would then be the model followed in the future.

These rulings build up a framework that future judges use to decide future cases (in theory). The legislature, in response, can more strictly define legal terms and this new definition becomes the new standard judges hold.

So, returning to my hypothetical, if the legislature didn't like how the common law definition of "retaliatory" was shaping up, they could step in and write a law that directed judges to apply the standard set forth in the new law.

Okay. Back to the bill.

Quoting from the bill's fiscal note, "Under current law, the Attorney General or a district attorney may bring a civil action on behalfof the state to seek the imposition of civil penalties against a person who violates the ColoradoConsumer Protection Act."

But, there is a common law ruling here that puts guiderails on what kinds of trade practices are unfair or deceptive. A 1998 Colorado Supreme Court decision holds that to be deceptive or unfair, a trade practice must have a significant impact on the public to be something you can sue over.

What's significant? Defining that is why we have so many lawyers and why they're so busy.

The new change to law brought about by this bill is exactly like what I mentioned above in my hypothetical. This new bill says that any evidence that someone engaged in unfair or deceptive trade practices, regardless of impact on the public, is enough to make them capable of being sued.

Big deal right? Do the crime, do the time.

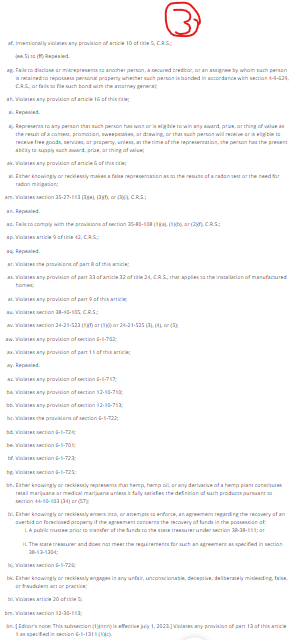

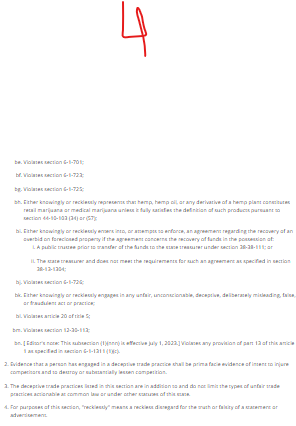

In order to understand the import of this change, you need to take a second and look at the list of things that our state law defines as unfair or deceptive. I attached those as screenshots 1 - 4. They're from the third link below.

I'm sorry for the long list. I tried and tried and tried to get the browser window size reduced enough to do one screen shot. Even at 33% size on the browser the list goes on for 4 screens!

And that's exactly the point here. Do you suppose it's hard to find something on that list to bring suit over? Look hard enough at that arm's length list and you (or the AG or a DA) could find something.

It could be a problem that is easily fixed and that harmed no one. None of that would matter under this new law.

The upshot is more defensive play by business. That means more hassle and more cost for them (and, eventually us). Toss them on the pile that the Democrats have been building since 2019 I suppose.

https://coloradoaccountabilityproject.substack.com/p/the-indirect-burden-democrat-policy?utm_campaign=post&utm_medium=web

https://leg.colorado.gov/bills/hb24-1014

https://law.justia.com/codes/colorado/2022/title-6/article-1/part-1/section-6-1-105/

A couple of bills on agriculture (farming and ranching) you should consider supporting...

I wanted to share a couple bills with you that you should consider supporting, particularly if Ag is your field or important to you.

**Note that the first of these bills is up for committee tomorrow, so if you intend to advocate, you'll have to be on it pretty quick.

So, let's jump in.

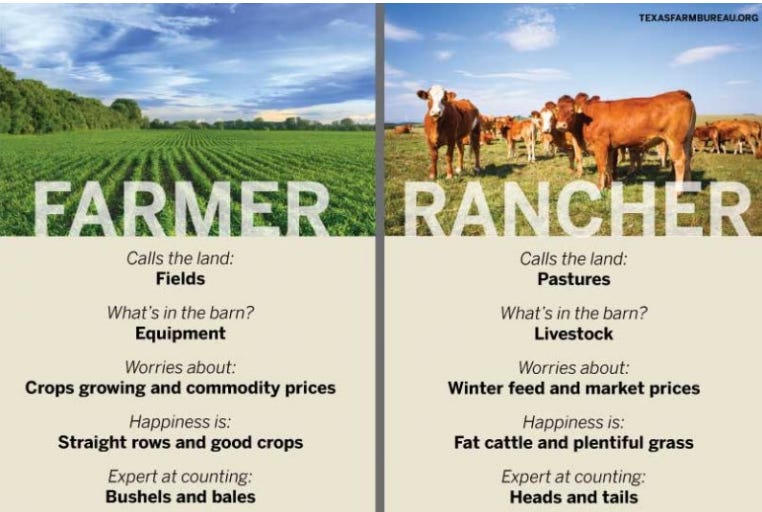

The first bill linked below is a tax credit for current producers (ranchers and farmers) to sell or lease land, cattle, or equipment to certain people, namely beginning farmers/ranchers or "socially disadvantaged" farmers/ranchers ("socially disadvantaged defined in federal statute, beginning defined in his proposed law).

I know many have concerns both about encouraging the next generation of producers and also many have concerns about keeping American land in American hands.

This bill is not a cure-all, but it's something and it's also something where you have a chance to weigh in and encourage it since it's a Colorado law (and we have a strong process for citizen input in this state compared to other states and the federal process).

Again, fair warning, it's up for committee tomorrow (the 15th) so get busy if you're going to advocate.

The second bill below is a bipartisan bill that gives a tax credit to farms and ranches for following certain stewardship practices. Since I know many producers already follow these practices, this one seems like a good idea to me. The fact that it's bipartisan too strikes me as another bit of evidence that it's likely not too far afield in terms of its requirements.

This one has no committee date as of this writing, but you can bookmark it and check back periodically.

Speak up for Ag in this state!

https://leg.colorado.gov/bills/hb24-1138

https://leg.colorado.gov/bills/hb24-1249

House Democrats vote down a bill by Reps Pugliese and Bottoms to lower the income tax rate.

Polis, a big proponent (or so he says) of tax cuts immediately castigates the move with words as powerful as tepid dishwater.

In a hearing Monday in the House Finance Committee, Democrats voted strictly along party lines to shut down a bill that would have taken the income tax rate down from 4.4% to 4%.

Polis, long touted by the media as in favor of tax cuts, and certainly one to blather on about same when it's convenient to do so, immediately responded with strong words in favor of the tax cut.

Quoting the Denver Post article below, he said through a spokesperson:

"'Gov. Polis is committed to working with the General Assembly on cutting taxes this year,' Wieman [Shelby Wieman--Polis' spokesperson] said in a statement. 'He appreciates the work of legislators on this issue and looks forward to working with the General Assembly on progressive tax policy, including an income tax cut this session to save Coloradans money.'"

Oh, go easy on 'em Polis.

I know you're the head of the Democrats in this state. I know that you've smiled and said how much you support cutting taxes.

Sometimes so strongly believed in cuts that you don't bother to correct reporters when they say you were responsible for the previous tax cuts (voters were and you had nothing whatsoever to do with the effort to put them on the ballot), but come on!

Don't be so hard on your fellow Dems. They're just doing what you want them to do right?

https://www.denverpost.com/2024/02/12/colorado-legislature-income-tax-cut-bill-rejected-committee/