Demographic notes: a three-parter. What are they? What did recent notes say? How can they be used to drive an agenda by politicians and advocates (e.g. the Post's Seth Klamann)?

What is a demographic note?

Before we get to talking about a couple of recent demographic notes and how they can (and were intended to?) be used to drive an agenda, I thought it might be wise to refresh an earlier discussion about demographic notes.

What are they?

By way of helping flesh them out, I want to contrast them with fiscal notes. Scrolling down on any particular bill's page (down past the top-line summary and you can practice with HB19-1184's page linked first below if you'd like) you'll find a box, a link, "View Recent Fiscal Note".

This fiscal note describes the bill in plain language and also gives an estimate of what this bill will cost. Quoting the Legislative Council Staff's Fiscal Note page (linked second below):

"The fiscal note provides a summary of the proposed law, an explanation of its fiscal impact on state and local government revenue and spending, and an explanation of how it will be implemented. Fiscal notes are based on a set of assumptions that take into account information collected from state agencies, local governments, and other entities or sources. During the legislative session, fiscal notes are updated to reflect amendments adopted that change the proposed measure's fiscal impact."

You see a fiscal note on every bill that is introduced.

By contrast, a demographic note (created by that very same HB19-1184) is something that only certain bills get, it's something they only get after passage, and it's something that needs to be requested. Quoting the Legislative Council Staff's Demographic Note page linked third below:

"HB 19-1184 requires Legislative Council Staff to prepare demographic analyses for up to 20 bills each year starting with the 2020 legislative session. Demographic notes outline the potential impact of a bill on disparities—including economic, employment, health, education, or public safety outcomes—for various populations in the state. Populations may be identified by their differences in race, ethnicity, sex, gender identity, sexual orientation, disability, geography, socioeconomic status, or other relevant characteristics for which data are available."

If you want to see the process involved in writing either the fiscal notes or the demographic notes, you will find more information on their respective sites.

If you would like to be involved in and/or track the progress of demographic notes, scroll down on that page. There is a gold button that lets you sign up for the email list and an email address you can address questions or comment to.

https://leg.colorado.gov/bills/hb19-1184

https://leg.colorado.gov/agencies/legislative-council-staff/fiscal-notes

https://leg.colorado.gov/agencies/legislative-council-staff/demographic-notes

A couple of the most recent demographic notes.

The previous post talked about what demographic notes are. If you don't know and didn't read the first post, go back and read.

I wanted to look at a couple of the most recent as examples, on our way to discussing what I think the likely intent of demographic notes is.

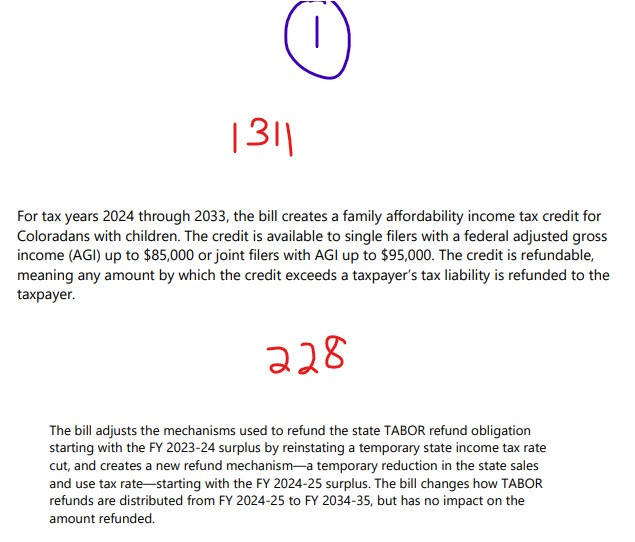

There are two bills linked below, along with their demographic notes (in the order bill --> note). They are HB24-1311 which took your TABOR refund and gave it to other people who have children and then SB24-228 which makes some temporary changes to the way the TABOR surplus will be refunded. Both demographic notes were requested by the Democrat caucus.

I took a screenshot of the bill summaries from their fiscal notes and attached as screenshot 1 if you want a more official summary.

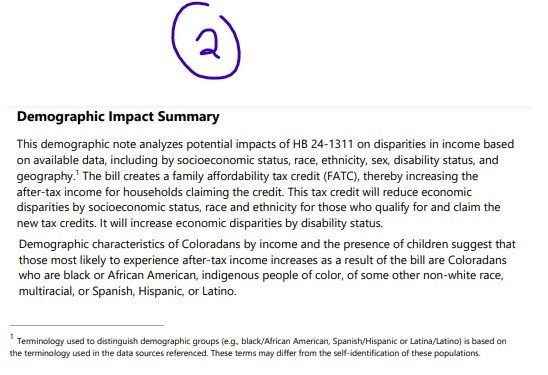

I won't go through both demographic notes in detail, but I do want to highlight the mechanics of one of them in broad strokes so you have a sense of what to look for. I'll just use the first one, the note for HB24 1311.

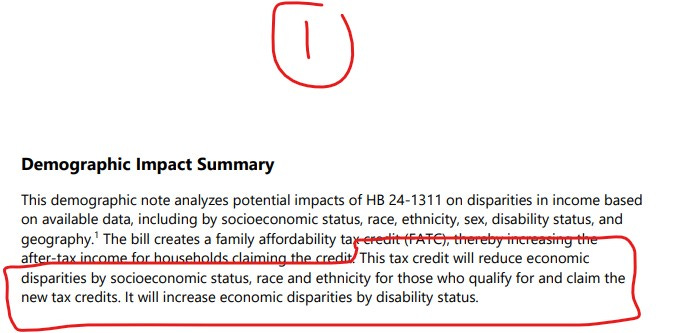

The summary is as good a place to start as any and I took it off the note to attach as screenshot 2. Note, this picture is reformatted from the way it is in the note since it spans two pages.

From this you get a sense of what these notes do, and what this one in particular is doing: we are here to talk about how this bill will affect a variety of demographic groups.

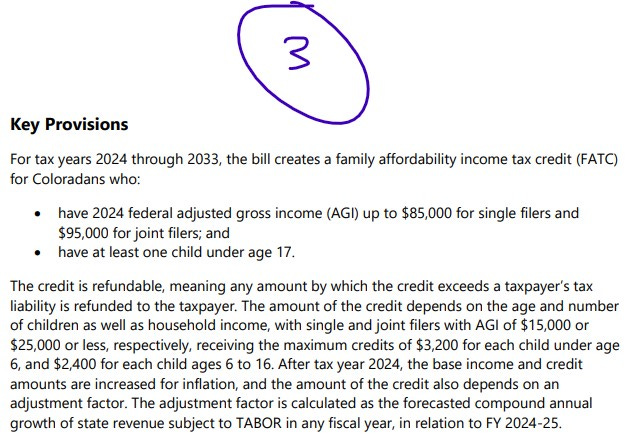

The bill lays out a tax credit scheme which you can see in screenshot 3.

You get varying amounts of tax credit depending on your family income. Now, the bill cannot legally (and I'm sure the Democrats would love to somehow pierce this veil) lay out a tax refund scheme by race or some other demographic characteristic, so there is no way to directly say that, for example, black people will get this much or that much thanks to this bill.

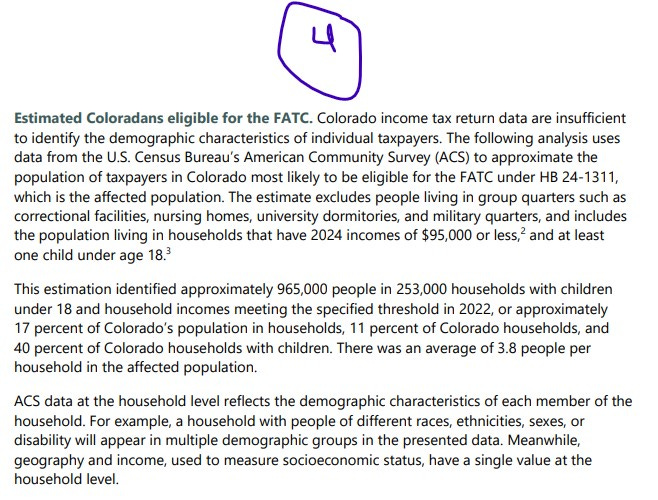

So the demographic note writers need a way to estimate how many people earn what income by race to get such an estimate. Skipping a lot of detail, they used census data to connect income to race, etc. That process is given in more detail in screenshot 4.

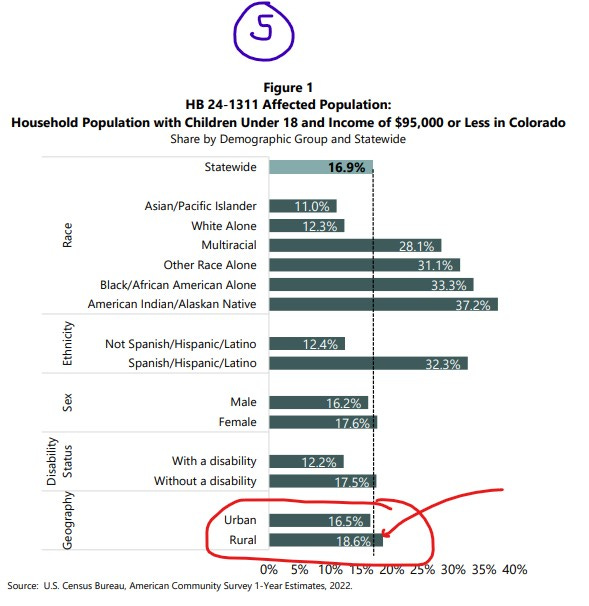

This is how they compare the impact of this bill on various demographic groups for the report. The results are in screenshot 5.

The way you read their figure is that the horizontal bars represent the percentage of Coloradans estimated to qualify for the tax refund. The dashed vertical line is the statewide average. Using the Rural/Urban category which I highlight in red, you can see that more rural people than average qualify. Thus the statement that rural Coloradans are more likely to benefit from this than urban.

Lastly, when you read reports like these, you are wise to ask yourself a couple things.

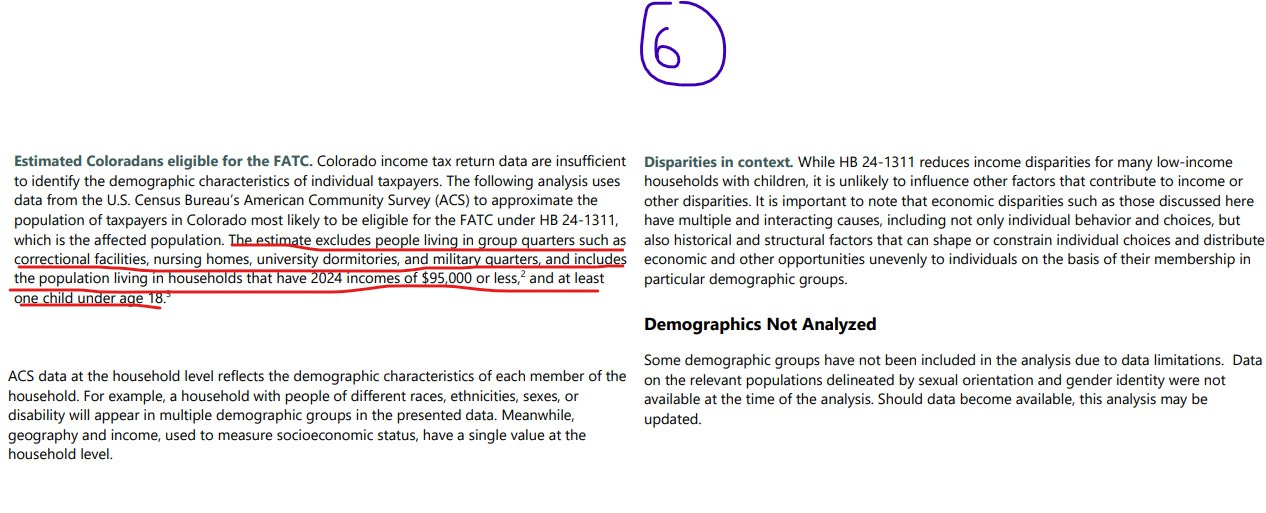

What methods did the authors use to arrive at their results. We covered this in brief here (thus I won't go into more detail), but I think you shouldn't consider yourself fully informed unless you read the report in full.

What are the boundaries of this report? In other words, what are the limitations and omissions that might affect the validity and applicability of this report? Again, a fuller understanding is had by reading, but I can give you a sample of the things from this report so you have a sense of what to watch for.

Screenshot 6 is a collection of relevant quotes from various places in the report. Look for things that talk about what was not checked, look for words that indicate where simplifying assumptions were made, etc.

But wait you say, there's a big omission here about what this does to the taxpayers who DON'T get a tax refund under this law.

I didn't forget. That's the next post.

https://leg.colorado.gov/bills/hb24-1311

https://s3-us-west-2.amazonaws.com/leg.colorado.gov/2024A/dn/HB1311_00.pdf

https://leg.colorado.gov/bills/sb24-228

https://s3-us-west-2.amazonaws.com/leg.colorado.gov/2024A/dn/SB228_00.pdf

Demographic notes driving agendas by both politicians and some reporters.

The impetus for this three part series was a tweet by Denver Post reporter Seth Klamann. I took a screenshot and attached.

Having talked about what they are and what they do, we are now at the point to discuss how it is that they can be used to further political (and social) agendas.

Before we get to that, however, I want to pause here to take a second and offer you the perspective of someone who thinks they're a public good. I refer you to the first link below for a piece for Pew about Colorado's demographic notes. You should pause to read this if for no other reason than to learn the arguments of those who support efforts like these. Know that my take on this issue isn't the only one.

My guess is that if you asked the sponsors of the bill creating demographic notes, they'd give reasons that echo those in the Pew link. I can't read minds, so I don't doubt that for some this is a sincere feeling.

I've lived long enough, and I'm cynical enough, however, to figure that there is also some political gamesmanship and advocacy in the mix. That is, that the effort is not entirely altruistic, in its use if nothing else.**

The way this works, for politicians and advocates, is, perhaps not surprisingly, exactly what you see in Mr. Klamann's tweets. It's a common trick in advocacy and politics: picking out what you want to emphasize, ignoring subtleties and ignoring things that don't make the point you'd wan tot make.

Since I used HB24-1311 in post 2, I will return to this demographic note. I put a link to that second below for convenience. If you want to double check what Klamann ignored in the other bill (the middle of his three tweets in the screenshot), go back to post 1 to see that bill's demographic note. Trust me that it won't be hard to find what Mr. Klamann left out, nor to surmise why.

Screenshot 1 shows the section of the report that Klamann quotes from.

That's the summary and fair enough to start with. This should not have been sufficient and including the summary without going into more detail is a fault. There are important details to include if one were after a full view of the note's conclusions.

The first detail to note is that we're discussing a tax refund here. We are not talking about income. No one is losing money due to government action. Maybe one group, on average, gets more money than another, but no one loses anything.

Wait, there is a group that will lose, but we'll come back to that.

Look at what I put up in screenshot 2.

The disparity mentioned in the summary, but not by Klamann, is explained later. People with disabilities won't get as much of a tax credit because they don't have kids at the same rate as other demographic categories. With fewer disabled people having kids on average, fewer disabled people will get a tax credit.

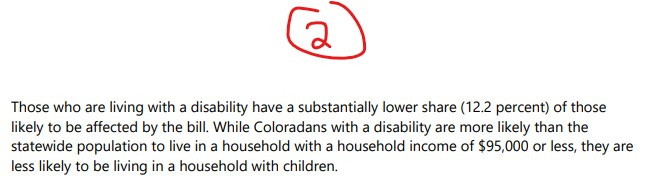

Now look at screenshot 3. Remember how I said there are people who will lose money because of this bill? Lose actual money, not just receive less of a benefit from the government?

You and I and any other tax payers outside the eligibility requirements put forward by HB 24-1311 lose money that we should have had refunded to us by our state. Money that should have come back to your family, my family, our children, and others is taken by the government and given to those that the Democrats find more sympathetic.

Not just that either. Quoting the demographic note: "Lower income taxpayers without children will experience a higher net tax burden under the bill from having TABOR refunds reduced." In other words, if you don't make much AND don't have kids, you like all the other non-qualifying families (those that could arguably stand the loss easier) take an income hit due to higher effective taxes.

This is all absent from Klamann's series of tweets. And that's, I think, the point.

I think the demographic notes are of questionable value. The process and the estimates used leave out way too much to draw detailed and reliable conclusions.

But, they do have the upside that they can be selectively quoted and misused to drive home whatever point a politician, activist, or reporter would like to make.

I had one last thing I wanted to check on re. the demographic notes, and that is how much you and I get to pay for these things. I wrote the legislative council staff and asked. I got the response back from Mr. Sobetski their chief economist. I attached that as screenshot 4.

**A quick bit of context here. It's important to remember that the notes are prepared by nonpartisan legislative staff who work hard to try and aim for truth without favor to any particular viewpoint. They're not perfect, but I can tell you that, having read a fair bit of their work across time, that they hit the mark much more often than they miss.

https://s3-us-west-2.amazonaws.com/leg.colorado.gov/2024A/dn/HB1311_00.pdf