Colorado Gives and First Bank are both major donors in JeffCo. Have you ever seen Newsline articles in your local paper? What is a Donor Advised Fund?

Colorado Gives and First Bank are both major donors in JeffCo

The Free State Colorado video linked below with Natalie Menten details how Colorado Gives gave $20K to a JeffCo group to help the county de-TABOR this last election.

Worth a watch, especially if you were like me and were unaware that this organization is getting mixed up in politics.

I found this concerning--the idea that a group I mainly associate with charity would be involved in politics. What's worse, I wondered whether or not they might be using those donations to help fund political activity.

I contacted Colorado Gives for some information about that. I spoke with executive director Kelly Dunkin and that conversation (along with their website) are the source for the below.

First a little history. Colorado Gives traces its history back to fundraising for the Lutheran Medical Center located in JeffCo. After some changes in both name and leadership, it's now on its own, but chooses to (in Dunkin's words) "honor its roots" by keeping most of its own charitable giving in JeffCo.

It is funded through its original endowment, but also gets some hefty gifts and grants from others (none of which they are required to reveal due to their nonprofit status).

Colorado Gives operates as a 501(c)(3) nonprofit. 501(c)(3)'s must meet the IRS requirements spelled out in detail in the second link below. In brief, 501(c)(3)'s must fit into one of the categories in screenshot 1 (from the second link).

They are also restricted in the kinds of other activities they undertake. 501(c)(3)'s can mix in politics, but they cannot make it a "major purpose" of their organization, something that has been the source of multiple investigations, court fights, and new laws here in Colorado.

Colorado Gives bills themselves as (and these words will sound familiar to any Coloradan who has looked into the web of charities and etc. operating here), a group that "connects people to nonprofits". In practical terms, this means operating a website where donors can go to donate quickly and easily to a range of nonprofits, but this is not all. They also use their status to help steward a variety of other endowments and Donor Advised Funds (yet another familiar activity to those who keep an eye on nonprofits operating here).

I asked Director Dunkin about the $20K donation and also about my concerns above. She confirmed that the foundation, after a vote by their board, did donate the money. The board felt as though the donation reflected their mission.

If you are wondering whether or not this donation tips them over the edge of politics being a major purpose of Colorado Gives, I wouldn't worry. It's not. $20K is a lot to me (maybe to you too), but it's a drop in the bucket for them. To give you some sense of scale here, look through their other grants starting on p 32 of their most recent IRS Form 990. That's the third link below.

As to someone's donations being used by Colorado Gives, Director Dunkin was quite emphatic in saying that no donation that comes through cogives.org or cogivesday.org is ever used, in any way, for any ballot issue or political purpose. Nor is it used by Colorado Gives for anything other than a tiny fraction to keep the donation infrastructure running.

I'm not able to find evidence to the contrary and I don't think there is any reason to believe they are lying.

Having said that, you should understand that you are not required to like what Colorado Gives is doing, nor are you required to donate through them.

If you find their involvement in de-TABORing unacceptable, or if you find some other thing they do likewise, don't work with them.

It's a free country and within the law, Colorado Gives, the foundation itself, can do as it sees fit with its own money. You are too. I am too.

By all means, please continue to give, just go directly to the nonprofits you want to support and give directly to them.

I might go a step further. If you have gone through Colorado Gives in the past and decide to stop, take the extra quick step of sending an email or calling to tell them why. That kind of feedback is important I believe because they may not be aware of how off-putting their choices are and it might lead to change.**

**I remember saying the same to a friend who is in law enforcement and who used to donate to LGBT causes but stopped after the organizers of the gay pride parade in Denver say police weren't welcome a few years back. Good general advice. If you stop donating, tell them why.

https://www.501c3.org/what-is-a-501c3/

https://coloradogivesfoundation.org/wp-content/uploads/2024/11/2023_CGF_PUBLIC_DISCLOSURE_COPY_990_and-_90T_RETURNS.pdf

Have you ever seen Newsline articles in your local paper?

If you have, check the byline, look at the bottom. Is your paper telling you about Newsline's political orientation? Their murky funding by leftist dark money and a host of Donor Advised Funds.

If they're not, you should write in and tell them to.

Colorado Newsline is a left-leaning paper staffed by people whose views can easily be categorized as outside the mainstream. The kind of "news" they are producing reflects this fact, but unfortunately, not many of the small local papers that use their free content look into Colorado Newsline that closely.

I did, and you should be informed. That's the piece below that ran in Complete Colorado.

https://pagetwo.completecolorado.com/2024/12/14/gaines-colorado-newsline-progressive-bias/

What is a Donor Advised Fund (DAF)?

Did you pick up on a common element in the previous two posts?

Both made mention of DAF's. I thought they would be worth covering, I have seen them a lot lately, and learning the "vocab" here will help us all join the conversation.

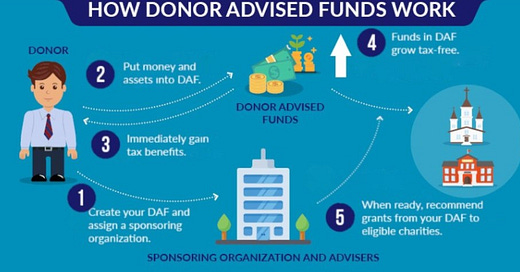

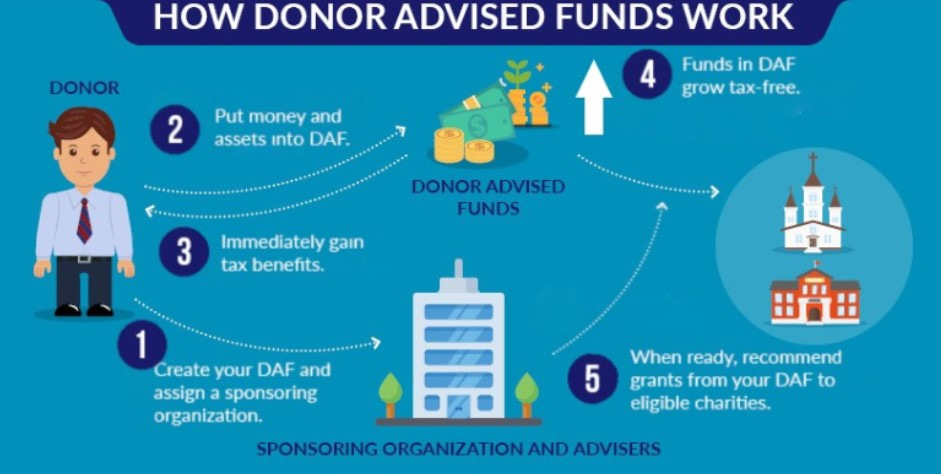

DAF's started out as a good idea. Let's say that you (and/or a bunch of other people) wanted to do some charitable giving. Good sized giving. You want to do it smart, however.

It would be nice if you could get some tax benefits (both in terms of a write-off and in terms of not paying for any interest or other gains in your money as it grows and presumably can do yet more good). If you take an invest your money into a special account, a DAF, that money can earn interest, growing so as to do more good than a single deposit could, and you can get a tax write-off while avoiding capital gains.

A good analogy here would be that you put your charitable donations into a special kind of money market account that pays out to the charities you want. In fact, many DAF's are housed in firms you are likely to think of in terms of investments/IRA's and not charity.

In the first post today, Colorado Gives does helps in this regard. They are one of many (both for- and nonprofit) groups that hosts your DAF account, doing the legal paperwork and compliance, etc. then paying out to charities you want.

As soon as you set up a DAF with them, you and any friends who pay into it get the immediate tax write off, the money earns interest, and the fund pays out to the people you choose.

The first link below gives some more detail on DAF's. Interestingly, they give it from the perspective of a charity that would be seeking money from a DAF.

Likely about 5 minutes after the invention of DAF's, someone got to thinking and figured out ways in which they could be exploited for purposes outside of pure, altruistic charity.

This is likely at least half of the reason that DAF's have grown over the last few years. The title and subtitle at the top of the Ohio State University (OSU) article linked second below says it all: "US regulators scramble to catch up with boom in donor-advised funds, Charitable giving funds essentially operate as foundations, but without same requirements"

The two main concerns about DAF's I want to highlight here are how much money is being paid out and donor transparency, this latter being the intersection of with the second post today where you see many nonprofit media outlets paid for by DAFs who do not reveal their donors. This despite, of course, these media outlets bragging about their transparency in revealing donors. See links 3 and 4 below for more context.

Charitable foundations are required by US law to distribute 5% of their assets in a given year, but DAF's are free from this requirement. As such, according to the OSU article, some charitable foundations are actually now setting up DAF's as a way to squirrel some of that money away! Quoting the OSU article (with links intact):

"Critics of DAFs say that the government should require them to regularly disburse at least some of their charitable funds. Foundations have faced that kind of obligation for more than five decades. They must pay out at least 5% of their assets each year – although some of that money can be used to pay for their operations or even be set aside in a donor-advised fund."

That brings us to the second concern I want to highlight, concerns around transparency. DAF's are not required to reveal their donors in the way that some organizations are. This, combined with the explosion in DAFs lately, raises big concerns about just exactly who is funding what (made all the worse by the fact that charities can start a DAF, put money in it and then pay out later).

Additionally, depending on the setup of the DAF, there might be issues around who is deciding where the money goes. Some DAF's are set up such that donors advise (but don't have a veto) on where the money goes.

Quoting again from the OSU article (with links intact):

"The proposed regulations [the IRS is currently putting draft regulations out for comment and deciding what, if any, new rules and regs to bring down on them] would identify certain distributions as taxable and declare that donors are not the only parties considered DAF advisers – the donors’ personal financial advisers are, too. This means the financial advisers, like donors, cannot receive any benefits from a DAF. In identifying taxable distributions, the regulations include the possibility that funds used to support lobbying or activities tied to political campaigns could lead to penalties for both the donor and the fund’s manager. And evidence suggests DAFs are commonly used to support lobbying."

These are real problems and I bring them to your attention so that in assessing the funding and motives of any organization (charitable, nonprofit media, etc.) you can be aware that not all funds, not all foundations, are charitable in nature and not all of them are equal in terms of how forthright they are with details of how they operate.

It also ought to make you question just how transparent any organization is that says it lists its donors. If all they provide is a list of DAF's, you may NOT be getting the full picture.

https://www.ccsfundraising.com/insights/how-do-donor-advised-funds-work/

https://news.osu.edu/us-regulators-scramble-to-catch-up-with-boom-in-donor-advised-funds/#:~:text=DAFs%20are%20not%2C%20however%2C%20subject,DAFs%20face%20neither%20requirement.

https://pagetwo.completecolorado.com/2024/12/14/gaines-colorado-newsline-progressive-bias/

https://pagetwo.completecolorado.com/2024/10/04/gaines-left-leaning-colorado-trust-influencing-colorado-journalism/

Good information. Thanks!