CFOIC's update (due to new laws) to their guide on CORA requests. Getting in a TIF over Urban Renewal. Brauchler's novel (and worthwhile) questions about Reps Epps' and Marshall's lawsuit.

How did recent changes to the law around CORA requests affect how you do them?

CFOIC has helpfully updated their excellent CORA guide (see the link below) to help you keep track of how changes will affect CORA requests. Good one to bookmark if you do CORA requests or are considering one.

I don't always agree with everything CFOIC does, but I'd have to say that I have tremendous respect for them and the work they're doing.

If you have some extra money and are of a mind to, you might consider donating to them to help them continue their work.

https://coloradofoic.org/open-government-guide/?fbclid=IwAR3eSjrhhKjRYBLglVepp1TC-auEqjQvHUxoxT7hWFUGc1SrbH1pDQaVyJA

A TIF in Loveland?

The story linked below is hyper-local, detailing a fight over the taxes in Loveland and development therein.

You're welcome to give it a look if you're interested and/or if you live there (and weren't already aware).

The reason for posting it here is twofold:

1. It provides an opportunity to remind you that ballot initiatives are not just the provenance of state level people with lots of money. You can do initiatives at the local level. Got a problem that you think you know how to solve? Have you tried to get your city council to do something that you feel is important but they won't?

A local initiative is well within the reach of a small group of volunteers and can be accomplished with little cash outlay. If you have an issue that you think an initiative could solve in your local area (like some of the folks in Loveland have done), but you don't know where to start, get with me. I can connect you to resources.

2. This article also allows me a chance to update on what Tax Increment Financing--TIF-- is (particularly germane with the serious discussion we're having as a state right now re. property taxes).

TIF is a way that politicians can help pay for things like Urban Renewal. The process works like this.

Let's say you have a city with an area that you would like to see some growth and development in. Maybe it's a bunch of empty buildings you would like to shine up and have nice fancy stores in, but maybe it's also a field that you want someone to build in.**

First, you form an urban renewal authority that will oversee this redevelopment and hand out government favors to those that want to build there. I say government favors because that is what TIF is.

You see, you want these nice new shops and apartments, but you can't force someone to build there and the government can't just step in and do so in the place of private business. in order to induce me (a developer who owns the land in the Urban Renewal Authority district) to come and build in your blighted area or empty field, you're going to offer me an incentive.

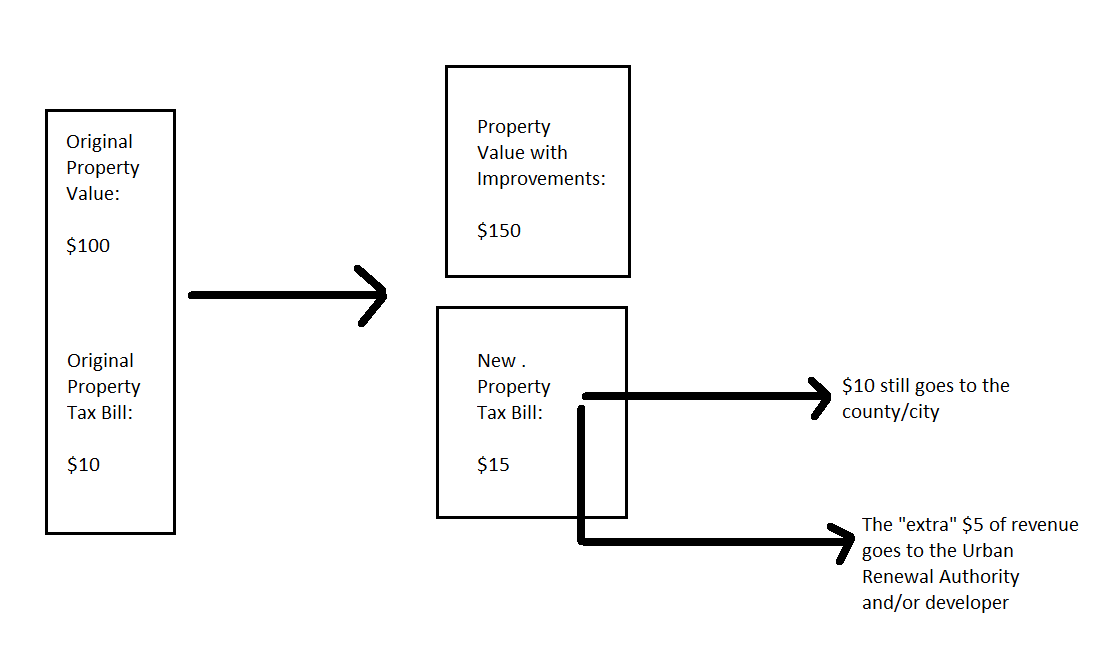

Take a look at the screenshot attached. It's the basic idea behind a TIF. When land is improved, it's worth more and thus generates more property tax. The idea behind a TIF is to "scrape off" that excess tax money and give it (in one form or another) to the developer. The gift might take the form of (depending on the rules about TIF's where you live) the city paying to knock down the old buildings and remediate any contaminated dirt, it can also take the form of paying for new water and sewer lines to be run into the Urban Renewal Authority area.

Since I, the developer, would normally pay for these things out of my own pocket, I think you can see now why I characterized the TIF as a gift to developers.

At this point, you might be wondering what the catch is. You know there is one. You know also that the way this works is taxpayers somehow end up holding the bag.

Yep. That's the case here. TIF's are often sold as a good way to finance new construction because, in theory at least, the original tax revenue (the $10 in my little sample in the screenshot) is not touched. Local services should continue apace and only the extra value created by the development is siphoned off.

Guess what though? New water lines mean new costs to maintain and supply water, same for sewer. More shops means more people and more costs for the basics that local governments provide.

Those extras get paid for by all the taxpayers. There is no free lunch after all. Thus, another paradigm for a TIF is that the government takes from you to give to a developer.

**One wrinkle here in all this Loveland fuss is that the land that they want to use an Urban Renewal Authority to develop was agricultural, i.e. an empty field. The discussion gets pretty complicated (see the second link below for details), but it all hinges on whether or not the land in question was in the boundary of the Urban Renewal Authority prior to 2010. My take on this is that rural land is not blighted, nor is it urban, and thus shouldn't be part of an URBAN renewal project. Lawyers and developers are clever little creatures, however, and they make a good living bending rules and common sense.

https://pagetwo.completecolorado.com/2023/07/08/food-tax-repeal-voter-approval-urban-renewal-on-loveland-ballot/

https://www.cpr.org/2023/05/24/jared-polis-veto-bill-loveland-development/

A different take on Reps Epps' and Marshall's accusations about open meetings laws violations at the Assembly.

I'll leave it to you to listen to the whole thing if you're curious, but Mr. Brauchler here raises an interesting question here.

And, as he points out, it's one the media has yet to ask.

Why did Epps and Marshall wait so long to raise their stink about the alleged violations of open meetings laws?

A good question and one I hope the media (or failing them, the courts) take up.

It was after all about 6 months after seeing these alleged violations that they came forward.

https://omny.fm/shows/the-george-show/brauchler-7-17-23-7am?in_playlist=podcast